MCA has notified new Companies (Auditor’s Report) Order, 2020 (hereafter referred to as CARO, 2020) on February 25, 2020 replacing the previous Companies (Auditor’s Report) Order, 2016. CARO and is applicable from immediate effect. As per CARO 2020, Auditor has to highlight the qualification in the report in Italics. CARO will be annexed to the main Audit Report in which an Auditor gives assurance of the compliances of the Accounting Standard and Companies Act made.

CARO, 2020 is divided into four sections viz. New Clauses, Re-instatement from old CARO versions, deletion of Clauses and brief Comparison with CARO, 2016.

1. NEW CLAUSES

1.1. Fixed Assets – Immovable Properties [Clause 3(i)]

1.1-1. Disclose immovable properties whose title is not held by the company [Clause 3(i)(c)]

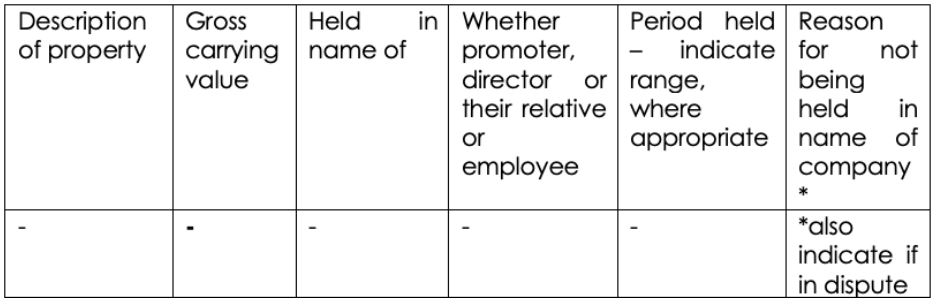

CARO 2020 requires disclosure of land and building and other immovable properties which are recognised as fixed assets but the title of such assets is not with the body corporate. In case immovable properties exist but in the Co’s name, then disclosure is required regarding Property description with ownership title ( Name and relation with the company executives), range of period for which property is held and the amount capitalised, the rationale for not holding the property in the name of the company. MCA has suggested the following format in this case:

One of the rationales is that accounting provisions apply only in case the title of the asset is held in the name of the company. Another rationale for such disclosure is to protect the interest of the lenders as Loans given by lenders to entities are based upon certain ratios which are dependent upon the amount of fixed assets recognised in the financial statements. With this disclosure, lenders would be in a better position to take a decision for financing the company when the title does not belong to the company.

1.1-2. Disclose revaluation for fixed assets or intangible assets happened during the year[Clause 3(i)(d)]

The company has to disclose if it’s Property, Plant and Equipment (including Right of Use assets) or intangible assets or both have been revalued during the year :

a) Whether the revaluation is based on the valuation by a Registered Valuer

b) Specify the amount of change, if change is 10% or more in the aggregate of the net carrying value of each class of Property, Plant and Equipment or intangible assets

Ind AS10 allows companies to follow either the cost model or the revaluation model. In case a company follows a revaluation model then a revaluation surplus is recognised in the balance sheet as a revaluation surplus. Further changes in the revalued amount are recognised in revaluation surplus or statement of profit and loss depending upon certain conditions and Auditors are required to highlight this upfront in the CARO report.

1.1-3. Disclosure required for Benami Transactions [Clause 3(i)(e)]

CARO 2020 requires disclosure for transactions even if proceedings are initiated (even if not complete) OR proceedings are pending against a company for holding any benami property. Since audit firms are required to sign the audit report, Auditors shall now be more stringent about the application of Benami Transactions (Prohibition) Act, 1988 (45 of 1988) and rules made thereunder.

Now management as well audit firms cannot take the shield of materiality and probability and have to provide notes to accounts in financial statements. Even if a transaction is not material, CARO requires disclosure in financial statements for proceedings regarding benami transactions in notes to accounts.

1.2. Working capital loan above Rs 5 crore – Auditors to tally returns or statements filed with banks with accounting books [Clause 3(ii)(b)]

Companies file a lot of accounting data (past information and projected statements) to banks and financial institutions to obtain working capital limits. The lender, on the other hand, is concerned about the accuracy of such data filed. The government has now stipulated that if the sanctioned limit(s), by combining limits of all banks/ FIs (Present/Proposed), exceed Rs 5 crores, then auditors are required to certify that quarterly results or the statements filed by the company with the banks are in line with the accounting books.

Considering the above provisions, auditors shall now be doing a pre-audit whenever the management is obtaining a new working capital loan or increasing their existing limits. Although CARO shall be filed by the end of the financial year the auditors shall insist upon management to get approval.

1.3. Disclosure of investments made in companies, firms, Limited Liability Partnerships or any other parties [Clause 3(iii)]

MCA intends to tighten the disclosures regarding repayment and realization of loans and advances given by entities.

It needs to be checked whether during the year the company has made investments in, provided any guarantee or security or granted any loans or advances in the nature of loans, secured or unsecured, to companies, firms, LLPs or any other parties. If yes, indicate aggregate amount during the year,

– to subsidiaries, joint ventures and associates;

– to parties other than subsidiaries, joint ventures and associates;

- whether the investments made, guarantees provided, security given and the terms and conditions are not prejudicial to the company’s interest;

- whether the schedule of repayment of principal and payment of interest has been stipulated and whether the repayments or receipts are regular;

- if the amount is overdue, state the total amount overdue for more than 90 days, and if reasonable steps have been taken by the company for recovery of the principal and interest;

- whether any loan or advance granted which has fallen due, has been renewed or extended or fresh loans granted to settle the overdues of existing loans given to the same parties, if so, specify the aggregate amount of such dues renewed or extended or settled by fresh loans and the percentage of the aggregate to the total loans or advances

- whether the company has granted any loans or advances in the nature of loans either repayable on demand or without specifying any terms or period of repayment, if so, specify the aggregate amount, percentage thereof to the total loans granted, aggregate amount of loans granted to Promoters, related parties as defined in clause (76) of section 2 of the Companies Act, 2013;

The focus of CARO 2020 is more towards highlighting any non-repayment or non-compliance by any errant party. From an accounting perspective [no change in accounting], any default in loans and advances made are accounted for by making a provision against the unrecoverable amount in the financial statements.

An auditor is required to report the aggregate amount and balance outstanding; whether the terms are prejudicial or not; whether the repayment plan has been specified and the repayment is in accordance with the terms agreed; the amount overdue; any extension or renewal of the amount fallen due during the period; and whether any loan or advance is granted to promoters or related parties without specifying repayment terms.

1.4. Highlighting incomes disclosed in tax assessments but not properly accounted in books of accounts[Clause 3(viii)]

1.4.1. Case A: Income was properly recognised in books of accounts but the income tax was not offered correctly. In case a company properly recorded income but while calculating income tax, income was not included or incorrect amount was included for assessing income tax and such income was offered to tax during the income tax assessments then auditors are required to consider such income. Proper accounting is to be ensured or to report in CARO disclosure.

1.4.2. Case B: Income was offered during income tax assessment and such income was not correctly recorded as per accounting provisions.

In case a company surrendered or offered income during income tax assessment and such income was either not recorded at all or recorded at incorrect amount or recorded in incorrect accounting period as per the accounting provisions then auditor needs to Treat such income as per the provisions of AS 5 and to report such income in CARO.

1.5. Default in repayment of loans or other borrowings or in the payment of interest [Clause 3(ix)(a)]

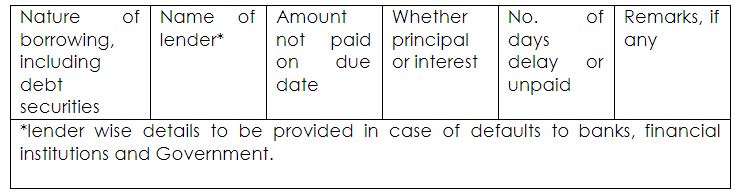

CARO 2016 specified the default on repayment of principal of financial institution, bank, Government or dues to debenture holders and CARO 2020 covers all the lenders and specifies the following format of disclosure:

1.6. Wilful defaulter [Clause 3(ix)(b)]

A wilful defaulter is defined as a company/ individual that has an ability to repay the loan but fails to do so. In case, a company defaults in repayments of loans, other borrowings or interest then the company is required to make such disclosure in the CARO report. Further, in case an entity has been disclosed as wilful defaulter by any financial institution (including banks) then auditor needs to highlight such fact in the CARO 2020 report.

This provision is introduced in view of the fact that number of wilful defaulters in nationalised banks have increased by over 60 per cent during the last five years.

1.7. Reporting of Whistle-blower complaints[Clause 3(xi)(c)]

This is one of the key steps introduced for marching towards corporate whistleblowers as at present, the Whistleblower Protection Act, 2014 is not applicable to corporates, government bodies, projects and offices.

CARO 2020 requires an auditor to report whistle-blower complaints received against the company.

1.8. Utilization of short-term funds for long-term purposes [Clause 3(ix)(d)]

CARO 2020 has even highlighted the requirement of disclosing the nature and amount of funds raised on short term basis and which has been utilised for long term purposes. This clause would protect the company and the stakeholders from the misutilisation of funds of the company and resulting in reduction of the defaults in repayment.

1.9. Purpose of funds obtained to meet obligations of subsidiaries, associates or joint ventures [Clause 3(ix)(e)]

Another important addition in the recent CARO is if the company has taken any funds from any entity or person on account of or to meet the obligations of its subsidiaries, associates or joint ventures, it needs to disclose the details and nature along with the amount of transactions.

1.10. Funds obtained on the pledge of securities held in its subsidiaries, joint ventures or associate companies [Clause 3(ix)(f)]

Now the Auditors need to specify in their report if the company has raised loans during the year on the pledge of securities held in its subsidiaries, joint ventures or associate companies, along with the details thereof and also report if the company has defaulted in repayment of such loans raised.

1.11. Fraud by and on the company [Clause 3(xi)(a)]

CARO 2020 has widened the scope of earlier Clause 3(x) of the CARO 2019 by deleting the words ‘by its officers or employees’ from the disclosure requirements in case any fraud by the company or any fraud on the company has been noticed or reported during the year. The auditors need to record the nature and the amount involved in the transaction.

1.12. Report under sub-section (12) of section 143 of the Companies Act, 2013 [Clause 3(xi)(b)]

The auditors need to record whether any report under sub-section (12) of section 143 of the Companies Act has been filed by the auditors in Form ADT-4 as prescribed under rule 13 of Companies (Audit and Auditors) Rules, 2014 with the Central Government.

1.13. Default in payment of interest on deposits or repayment [Clause 3(xii)(c)]

MCA has inserted this additional reporting requirement in case there is any default in payment of interest on deposits or repayment thereof for any period by the Company.

1.14. Internal Audit [Clause 3(xiv)]

An Auditor need to report if the company has an internal audit system commensurate with the size and nature of its business and if the reports of the Internal Auditors for the period under audit were considered by the statutory auditor.

This clause has been inserted to systemise the audit procedure and effectively implement the same in the Company.

1.15. Carrying on NBFC Business or becoming a Core Investment company[Clause 3(xvi)]

Core investment companies (CIC) are NBFCs holding at least 90% of their net assets in the form of investment in equity shares, preference shares, debt or loans, debentures, bonds in group companies. CARO 2020 requires an auditor to check whether an entity which is carrying on NBFC business, housing finance activities without a valid Certificate of Registration from Reserve Bank of India (RBI) or does a CIC fulfil the criteria of a CIC, and in case the company is an exempted or unregistered CIC, whether it continues to fulfil such criteria. If there are a group of CICs, then the auditor is required to provide number of CIC companies under that group.

The main rationale behind this disclosure requirement in CARO 2020 is because large CIC companies have recently defaulted.

1.16. Cash losses [Clause 3(xvii)]

An auditor now will have to report if the company has incurred cash losses in the financial year and in the immediately preceding financial year along with the amount of loss incurred.

1.17 Resignation of Statutory auditors [Clause 3(xviii)]

Presently, section 139 of the Companies Act, 2013 prescribes various compliances with respect to an auditor resignation. The new CARO requires disclosure by the new auditor in case a statutory auditor has resigned with the reasons and the issues raised by the previous auditor. If the reasons behind the resignation is something like hiding of material information by management, code of ethics is being violated or involvement of entity in accounting scandals then in such cases, it becomes important for the new auditor to communicate with outgoing auditor to consider the facts before deciding to accept the audit assignment.

Practically, this requirement is fulfilled by sending a courtesy letter by the new auditor to the previous auditor regarding their appointment seeking any objection or issue the previous auditor wants to highlight.

1.18 Uncertainty in repayment of Liabilities [Clause 3(xix]

Disclosure required in this clause would enable the auditor to determine whether an entity is financially stable. This clause is more about assessing the validity of fundamental accounting assumption of going concern in accordance with Standards on Auditing (Revised) 570 and then respond to the CARO clause.

CARO 2020 requires a specific certification that no material uncertainty exists in a company to pay its liabilities within a period of one year from the due date. This new clause has increased the auditor’s responsibility to determine and disclose the financial health of an entity to meet its liabilities existing in the balance sheet.

1.19 Unspent amount on Corporate Social Responsibility (CSR) expenditure [Clause 3(xx)]

Section 135 of the Companies Act, 2013 requires certain class of companies to spend 2% of their average net profits of past 3 years in pursuance of its Corporate Social Responsibility Policy.

Any amount remaining unspent on CSR activities (except due to some ongoing projects) shall be transferred within a period of thirty days from the end of the financial year to a special account to be opened by the company in that behalf for that financial year in any scheduled bank in the name of “ Unspent Corporate Social Responsibility Account”, and such amount shall be spent by the company in pursuance of its obligation towards the CSR Policy within a period of three financial years from the date of such transfer, failing which, the company shall transfer the same to a Fund specified in Schedule VII of the Companies Act, 2013, within a period of thirty days from the date of completion of the third financial year.

In case the company contravenes such provision, then there are penal provisions in the Act and disclosure of any unspent amount is to be reported by the auditor in CARO report.

1.20 CARO for Consolidated Financial Statements [Clause 3(xxi)]

In case of multiple subsidiaries, joint ventures and associates, it is possible that one audit firm may take all the audits of group entities or various audit firms may be involved for the audit of the entire group. CARO 2020 requires that in case respective auditors have made any qualifications or adverse remarks then the following disclosure should be made:

a) Details of such companies [Name and relationship – Subsidiaries, Joint venture and Associates]

b) Clause no. of respective CARO report of such companies containing such qualifications and adverse remarks.

CARO 2020 recognises the fact that there can be few matters which should be addressed via CARO report for consolidated financial statements.

2. REINSTATEMENT OF CLAUSES FROM PREVIOUS CARO VERSIONS

Following clauses have been re-instated from previous CARO versions:

a) Cash losses incurred [Clause 3(xvii)]

b) Internal audit system [Clause 3(xiv)]

3. DELETION OF CLAUSE FROM CARO, 2016

The clause Managerial remuneration [Clause 3(xi))] has been deleted from CARO, 2016.

4. BRIEF COMPARISON OF CARO, 2020 WITH CARO, 2016

The previous CARO did not cover the records showing full particulars of intangible assets and was not applicable to disclosures on Fixed Assets – Immovable Properties, Working capital loan above Rs 5 crore where auditors need to tally returns or statements filed with banks with accounting books, Disclosure of investments made in companies, firms, Limited Liability Partnerships or any other parties, Highlighting incomes disclosed in tax assessments but not properly accounted in books of accounts, Default in repayment of loans or other borrowings or in the payment of interest, Wilful defaulter, Reporting of Whistle-blower complaints, Utilization of short-term funds for long-term purposes, Purpose of funds obtained to meet obligations of subsidiaries, associates or joint ventures, Funds obtained on the pledge of securities held in its subsidiaries, joint ventures or associate companies, Report under sub-section (12) of section 143 of the Companies Act, 2013, Default in payment of interest on deposits or repayment, Internal Audit system, Carrying on NBFC Business or becoming a Core Investment company, Cash losses, Resignation of Statutory auditors, Uncertainty in repayment of Liabilities, Unspent amount on Corporate Social Responsibility (CSR) expenditure and CARO for Consolidated Financial Statements which have now been made part of CARO 2020 and altered the reporting requirements in case of any Fraud by and on the company in the current CARO.

ConclusionCARO 2020 is one of the Government’s major initiatives with the primary objective of necessitating greater transparency by fortifying corporate governance under the Companies Act, 2013 as applicable for the audit of financial statements of eligible companies. Earlier it was applicable for the financial years commencing on or after the 1st April 2019 but keeping in view the massive effect of Covid19 and the recent lockdown, the Government has decided to make it effective for the next Financial Year i.e. FY 2020-21.

Written and compiled by

CA Sunil Kumar Gupta

Founder Chairman, SARC Associates