Investment through Indian companies in foreign is a common phenomenon and several Indian companies have a presence in foreign companies by virtue of the formation of Joint Venture (JV) and Wholly Owned Subsidiaries (WOS). In contrast, Overseas Direct Investment by Indian residents has been revised to sanction overseas investment, with adequate manacles to prevent money from siphoning into foreign companies.

Therefore, adequate measures and regulations have been introduced and are being revised constantly to prevent any such event.

Reserve Bank of India (RBI) with effect from August 2022 has incorporated erstwhile FEMA (Transfer or Issue of Foreign Security) Regulations, 2004 and FEMA (Acquisition and Transfer of immovable property outside India) Regulation 1915 (OI Rules), which has introduced FEMA (Overseas Investment) Rules, 2022 (OI Regulation) and earlier regulations are considered superseded.

The FEMA (Overseas Investment) Directions, 2022 contains operational requirements under OI Rules and OI Regulations, including guidance regarding the interpretation, a grouping of conditions (under 3 categories, i.e., General provisions, Specific provisions, and Other operational instructions to AD banks).

In addition to that, it also contains particular compliance requirements from former ODI Master Directions and does not fall under OI rules and regulations.

With that, overseas investment in foreign is constricted unless completed in accordance with FEMA Act, OI Rules, and Regulations. This blog provides you with an overview of the latest notified and revised rules and regulations, including board amendments in RBI ODI.

India’s outbound investments have undergone a significant transformation, not only in terms of their scale but also in their geographical distribution and the sectors they target. Analyzing the trends in direct investments over the past decade reveals that while both inbound and outbound investment flows were relatively slow in the early part of the decade, they gained momentum in the latter half.

Over the last decade or so, there has been a noticeable shift in the destinations of overseas investments. In the first half, these investments were primarily focused on resource-rich nations like Australia, the United Arab Emirates (UAE), and Sudan. However, in the latter half, there was a shift towards nations offering greater tax advantages, such as Mauritius, Singapore, the British Virgin Islands, and the Netherlands.

Indian companies primarily engage in foreign investments through mergers and acquisitions (M&A). A developing country like India continually seeks opportunities to invest abroad as it contributes to the overall economy. These overseas investments by Indian companies also play a role in enhancing the performance of the country’s service and manufacturing sectors and contribute to addressing the challenge of rising unemployment rates. With the increasing M&A activity, companies gain direct access to new and broader markets, as well as advanced technologies, allowing them to expand their customer base and establish a global presence.

Overview of Amendments in RBI ODI

Investments made by individuals residing in India in foreign countries broaden the scale and range of business activities for Indian entrepreneurs. They offer global avenues for expansion, enabling easier access to technology, research and development resources, access to a broader global market, and lower capital costs. These advantages enhance the competitiveness of Indian businesses and contribute to the strengthening of their brand reputation.

Furthermore, such overseas investments serve as significant catalysts for foreign trade and the transfer of technology. This, in turn, leads to increased domestic employment, higher levels of investment, and overall economic growth through these interconnected relationships.

In alignment with the principles of liberalization and the facilitation of a more business-friendly environment, the Central Government and the Reserve Bank of India have undertaken a progressive simplification of procedures and a rationalization of rules and regulations governed by the Foreign Exchange Management Act, 1999. As a significant step in this direction, a new Overseas Investment framework has been put into operation.

The Central Government has issued the Foreign Exchange Management (Overseas Investment) Rules, 2022, through Notification No. G.S.R. 646(E) dated August 22, 2022, and the Reserve Bank of India has notified the Foreign Exchange Management (Overseas Investment) Regulations, 2022, under Notification No. FEMA 400/2022-RB dated August 22, 2022. These regulations supersede the previous Notification No. FEMA 120/2004-RB dated July 07, 2004 (Foreign Exchange Management – Transfer or Issue of any Foreign Security – Amendment – Regulations, 2004) and Notification No. FEMA 7 (R)/2015-RB dated January 21, 2016 (Foreign Exchange Management – Acquisition and Transfer of Immovable Property Outside India – Regulations, 2015).

The new framework simplifies the existing system for overseas investments by Indian residents, extending its coverage to a broader spectrum of economic activities, and substantially reducing the necessity for seeking specific approvals. This, in turn, will alleviate the burden of compliance and the associated compliance costs.

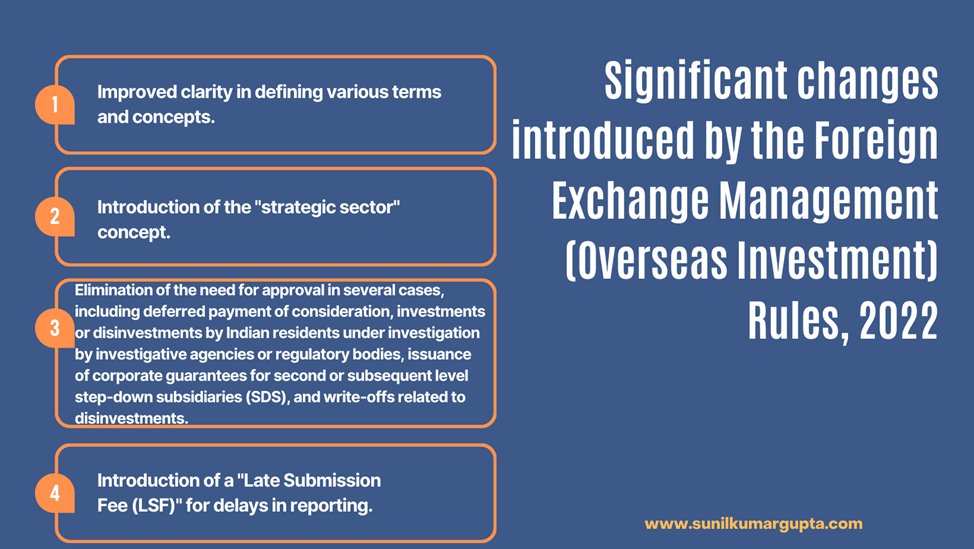

Some of the significant changes introduced by the new rules and regulations:

(i) Improved clarity in defining various terms and concepts.

(ii) Introduction of the “strategic sector” concept.

(iii) Elimination of the need for approval in several cases, including deferred payment of consideration, investments or disinvestments by Indian residents under investigation by investigative agencies or regulatory bodies, issuance of corporate guarantees for second or subsequent level step-down subsidiaries (SDS), and write-offs related to disinvestments.

(iv) Introduction of a “Late Submission Fee (LSF)” for delays in reporting.

Permission for Initiating Overseas Investments:

(1) An individual residing in India is allowed to make or transfer investments or financial commitments abroad under the general permission/automatic route, subject to the regulations outlined in the OI Rules, Regulations, and these guidelines. Consequently, overseas investments can be made in a foreign enterprise engaged in legitimate business activities, either directly or through second or subsequent-level step-down subsidiaries (SDS) or special-purpose vehicles (SPV).

(2) To make the intended financial commitment, the person should complete Form FC as provided in the “Master Direction – Reporting under the Foreign Exchange Management Act, 1999,” supported by the necessary documents, and approach the designated authorized dealer (AD) bank to facilitate the investment or remittance.

(3) In cases where approval is required, the applicant should approach their designated AD bank, which will then submit the proposal to the Reserve Bank of India (RBI) after conducting a thorough examination and providing specific recommendations. The designated AD bank, before forwarding the proposal, must submit relevant sections of Form FC in the online Overseas Investment Declaration (OID) application and include the transaction number generated by the application in their reference. The proposal should be accompanied by the following documents:

• Background and brief details of the transaction.

• Reason(s) for seeking approval mentioning the extant FEMA provisions.

• Observations of the designated AD bank with respect to the following:

- Prima facie viability of the foreign entity;

- Benefits which may accrue to India through such investment;

- Financial position and business track record of the Indian entity and the foreign entity;

- Any other material observation.

• Recommendations of the designated AD bank with confirmation that the applicant’s board resolution or resolution from an equivalent body, as applicable, for the proposed transaction(s) is in place.

• Diagrammatic representation of the organisational structure indicating all the subsidiaries of the Indian entity horizontally and vertically with their stake (direct and indirect) and status (whether operating company or SPV).

• Valuation certificate for the foreign entity (if applicable).

• Other relevant documents properly numbered, indexed and flagged.

Mode of Payment

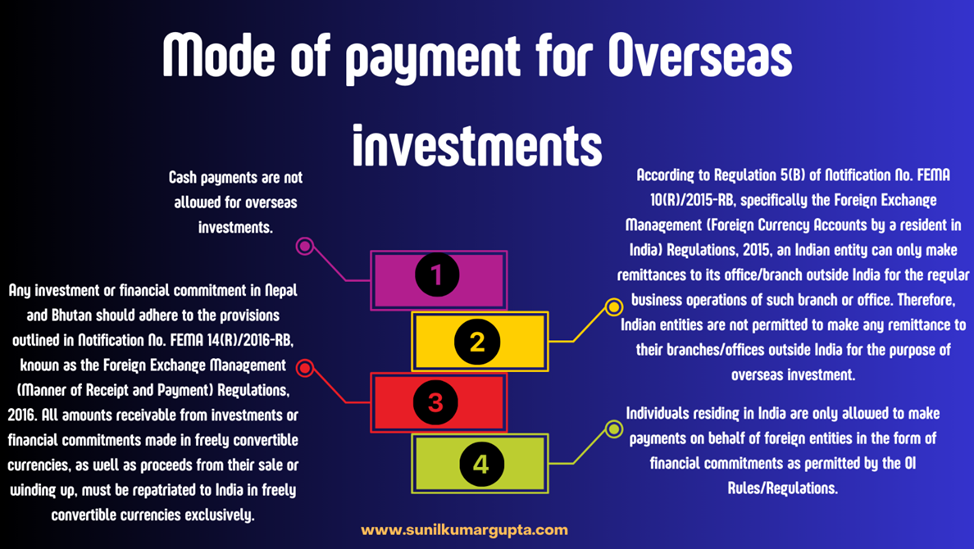

Regarding the method of payment for overseas investments made by an individual residing in India, the following provisions must be adhered to, as per regulation 8 of the OI Regulations. Additionally:

Pricing Guidelines

(1) Before facilitating any transaction related to overseas investments, the Authorized Dealer (AD) bank must ensure compliance with the regulations specified in rule 16 of the OI Rules. Regarding the documents to be collected by the AD bank, they should adhere to a policy approved by their board, which should consider factors including valuation based on internationally accepted pricing methodologies. The AD bank is required to establish and implement a board-approved policy within two months from the date of issuance of these guidelines.

(2) This policy can also address situations where valuation may not be mandatory, for instance, in cases involving transfers due to merger, amalgamation, demerger, or liquidation, where the price has been approved by a competent court or tribunal in accordance with Indian laws and/or the host jurisdiction. Another scenario could be when the price is readily available on a recognized stock exchange, and so on. The policy should also clearly specify additional documents, such as the audited financial statements of the foreign entity, which the AD banks may request to verify the legitimacy in cases where investments are being written off.

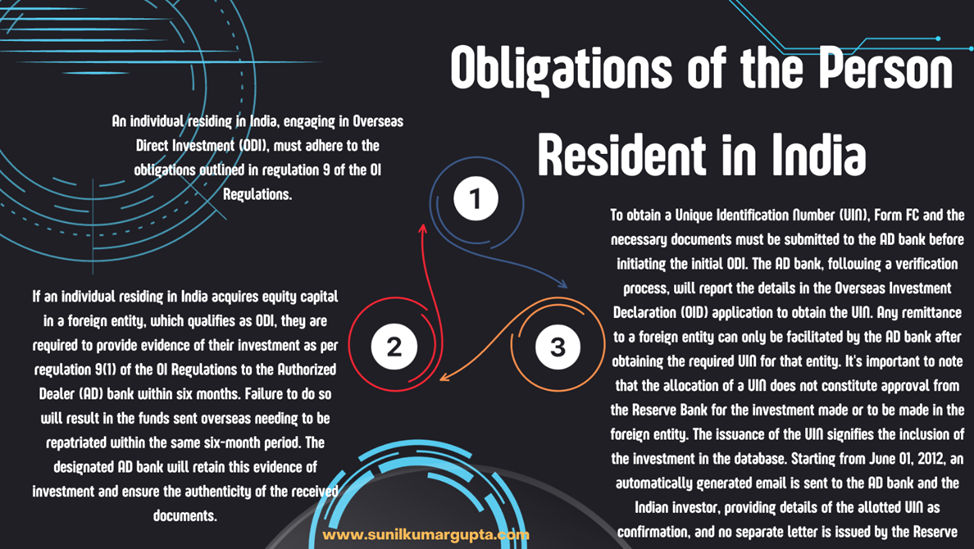

Obligations of the Person Resident in India

Reporting

(1) All reporting related to overseas investments made by individuals residing in India should follow the guidelines specified in regulation 10 of the OI Regulations. This reporting should be done through the designated Authorized Dealer (AD) bank using the updated reporting forms and instructions outlined in the “Master Direction – Reporting under the Foreign Exchange Management Act, 1999.” The reporting forms can be downloaded from the Reserve Bank’s website at www.rbi.org.in. Any incomplete submissions will be treated as non-submissions.

(2) Any acquisition of foreign securities resulting from the conversion of Indian Depository Receipts (IDRs) must be duly reported, either as Overseas Direct Investment (ODI) or Overseas Portfolio Investment (OPI), as applicable.

(3) The Annual Performance Report (APR) should be certified by a chartered accountant in cases where statutory audits are not applicable, including for resident individuals. It’s important to note that in cases where APR is required to be jointly filed, one investor may be authorized by the other investors to submit the APR, or they may jointly file the report.

(4) When a resident individual engages in overseas investments, they must adhere to the reporting requirements outlined in the OI Regulations. Additionally, reporting should also be carried out as per the Liberalized Remittance Scheme (LRS) guidelines when such investments are considered part of the LRS limit. It’s worth noting that the acquisition of foreign securities through inheritance or gift, in accordance with paragraph 2 of Schedule III of the OI Rules, is not counted against the LRS limit and, therefore, does not require reporting under the LRS.

Delay in Reporting

(1) If an individual residing in India has experienced a delay in filing or submitting the necessary forms, returns, or documents, they have the option to file or submit these documents and pay the Late Submission Fee (LSF) through the designated Authorized Dealer (AD) bank, as specified in regulation 11 of the OI Regulations.

(2) The Late Submission Fee (LSF) for delays in reporting transactions related to overseas investments will be calculated based on the following matrix:

| Sr. No. | Type of Reporting delays | LSF Amount (INR) |

| 1 | Form ODI Part-II/ APR, FLA Returns, Form OPI, evidence of investment or any other return which does not capture flows or any other periodical reporting | 7500 |

| 2 | Form ODI-Part I, Form ODI-Part III, Form FC, or any other return which captures flows or returns which capture reporting of non-fund based transactions or any other transactional reporting | [7500 + (0.025% × A × n)] |

Notes:

a) “n” is the number of years of delay in submission rounded-upwards to the nearest month and expressed up to 2 decimal points.

b) “A” is the amount involved in the delayed reporting.

c) LSF amount is per return.

d) Maximum LSF amount will be limited to 100 per cent of ‘A’ and will be rounded upwards to the nearest hundred.

e) Where an advice has been issued for payment of LSF and such LSF is not paid within 30 days, such advice shall be considered as null and void and any LSF received beyond this period shall not be accepted. If the applicant subsequently approaches for payment of LSF for the same delayed reporting, the date of receipt of such application shall be treated as the reference date for the purpose of calculation of LSF.

f) The option of LSF shall be available up to three years from the due date of reporting/submission under OI Regulations. The option of LSF shall also be available for delayed reporting/submissions under the Notification No. FEMA 120/2004-RB and earlier corresponding regulations, up to three years from the date of notification of OI Regulations.

g) In case a person resident in India responsible for submitting the evidence of investment or filing any forms/returns/reports, etc. as per OI Regulations/earlier corresponding regulations, neither makes such submission/filing within the specified time nor makes such submission/filing along with LSF as provided in regulation 11 of OI Regulations, such person shall be liable for penal action under the provisions of FEMA, 1999.

(3) The LSF may be paid by way of a demand draft drawn in favour of “Reserve Bank of India” and payable at the Regional Office concerned (in accordance with UIN mapping given in the table below).

| Sr.No | UIN with prefix | UIN mapped to |

| 1. | AH | RO Ahmedabad |

| 2. | BG | RO Bengaluru |

| 3. | BL or BY or PJ | RO Mumbai |

| 4. | BN or CA or GA or GH | RO Kolkata |

| 5. | CG or JM or JR or KA or ND or PT or WR | RO New Delhi |

| 6. | HY | RO Hyderabad |

| 7. | KO or MA | RO Chennai |

Restrictions and prohibitions

(1) Authorized Dealer (AD) banks are prohibited from facilitating transactions involving any foreign entity engaged in activities mentioned in rule 19(1) of the Overseas Investment (OI) Rules or located in countries/jurisdictions as advised by the Central Government under rule 9(2) of the OI Rules. It’s important to clarify that financial products linked to the Indian Rupee include non-deliverable trades related to foreign currency-INR exchange rates, as well as stock indices connected to the Indian market, among other things.

(2) Individuals residing in India are not allowed to make financial commitments to a foreign entity that has invested or plans to invest in India at the time of such commitment or at any time thereafter, either directly or indirectly, resulting in a structure with more than two layers of subsidiaries. This restriction is in accordance with rule 19(3) of the OI Rules. It’s also specified that no additional layer of subsidiaries should be added to any structure that already has two or more layers of subsidiaries after the notification of the OI Rules/Regulations.

Please note that the term “subsidiary” is defined as an entity in which the foreign entity has control, which includes a stake of 10% or more in an entity, as per the OI Rules.

Financial commitment by an Indian entity

An Indian entity, subject to the overall limit specified in Schedule I of the Overseas Investment (OI) Rules and in compliance with Regulation 3 of the OI Regulations, is permitted to make financial commitments through Overseas Direct Investment (ODI) as outlined in Schedule I of the OI Rules, financial commitments through debt in accordance with Regulation 4 of the OI Regulations, and non-fund-based financial commitments in line with Regulations 5, 6, and 7 of the OI Regulations. Furthermore:

(1) In cases of security swaps, both legs of the transaction must adhere to the provisions of the Foreign Exchange Management Act (FEMA), as applicable.

(2) When a registered Partnership firm from India invests in a foreign entity, it is acceptable for individual partners to hold shares on behalf of the firm in the foreign entity, provided that the host country’s regulations or operational requirements necessitate such holdings.

(3) Financial commitments through debt [Regulation 4 of the OI Regulations] – Authorized Dealer (AD) banks are authorized to facilitate outward remittances for financial commitments through debt only after obtaining the necessary agreements/documents to ensure the legitimacy of the transaction. An Indian entity is not allowed to lend directly to its overseas second or subsequent-level step-down subsidiary (SDS). Additionally, a resident individual cannot make financial commitments through debt.

(4) Regarding financial commitments through Guarantees [Regulation 5 of the OI Regulations]:

a) In the case of performance guarantees, the specified time for contract completion is considered the validity period of the guarantee.

b) No prior approval from the Reserve Bank of India is required for remitting funds from India due to the invocation of a performance guarantee extended in accordance with OI Rules/Regulations.

c) Any guarantee, up to the amount invoked, will no longer be considered part of the non-fund-based financial commitment but will be categorized as a financial commitment through debt. The invocation of such guarantees must be reported in Form FC.

d) The roll-over of guarantees is not regarded as a new financial commitment. However, such roll-overs should be reported in Form FC.

e) A group company of the Indian entity may provide a guarantee in compliance with the OI Regulations if it is eligible to make ODI as per the OI Rules. Such a guarantee will count towards the utilization of the financial commitment limit of the group company and must be reported by the respective group company. In the case of a resident individual promoter, this guarantee will be counted towards the financial commitment limit of the Indian entity and reported accordingly. The concept of utilizing the net worth of the subsidiary/holding company by the Indian entity is no longer applicable. Additionally, when computing the financial commitment limit of the group company, any fund-based exposure of the group company to the Indian entity or of the Indian entity to the group company should be subtracted from the net worth of the group company.

(5) The provisions related to financial commitments through pledge/charge [Regulation 6 of the OI Regulations] are summarized below:

|

Security by Indian entity |

In whose favour |

Facility availed |

Amount reckoned towards financial commitment |

|

A) Pledge the equity capital of the foreign entity /its SDS outside India. |

AD bank or a public financial institution in India or an overseas lender. |

Fund/non-fund based facilities for Indian entity. |

Nil. |

|

Fund/non-fund based facilities for any foreign entity/its SDSs outside India. |

The value of the pledge or the amount of the facility, whichever is less. |

||

|

A debenture trustee registered with SEBI in India. |

Fund based facilities for Indian entity. |

Nil. |

|

|

B) Create charge on its assets (other than A above) in India [including the assets of its group company or associate company, promoter and / or director]. |

AD bank or a public financial institution in India or an overseas lender. |

Fund/non-fund based facility for any foreign entity/its SDS outside India |

The value of charge or the amount of the facility, whichever is less |

|

Overseas or Indian lender. |

fund/non-fund based facilities for Indian entity. |

Nil. |

|

|

C) Create charge on the assets outside India of the foreign entity/ its SDS outside India. |

An AD bank in India or a public financial institution in India. |

Fund/non-fund based facility for any foreign entity/its SDS outside India. |

The value of the charge or the amount of the facility, whichever is less. |

|

Fund/non-fund based facility for Indian entity. |

Nil. |

||

|

a debenture trustee registered with SEBI in India. |

fund based facilities for Indian entity. |

Nil |

(6) Financial commitments through pledges or charges must adhere to the following conditions:

– The value of the pledge or charge, or the amount of the facility, whichever is less, will be considered against the financial commitment limit, provided that such a facility has not already been counted towards the prescribed limit.

– The overseas lender for whom the pledge or charge is created must not be from a country or jurisdiction where financial commitments are not permitted under the Overseas Investment (OI) Rules.

– The creation and enforcement of such pledges or charges must comply with the relevant provisions of the Foreign Exchange Management Act (FEMA) or the rules, regulations, or directions issued under FEMA.

– The assets on which the charge is created must not be securitized.

– If the duration of the charge is not specified upfront, it should align with the period of the facility (e.g., a loan or other financial facility) for which the charge has been established.

– In case of the enforcement of a charge created on domestic assets, those domestic assets should only be transferred through a sale to a person residing in India.

– When creating a pledge involving shares of an Indian company in favor of an overseas lender, the pledge should also comply with the existing FEMA provisions as outlined in the FEMA (Non-Debt Instruments) Rules, 2019.

(7) The provisions regarding Overseas Direct Investment (ODI) in financial services activities [as per paragraph 2 of Schedule I and paragraph 2 of Schedule V of the OI Rules] are summarized as follows:

| Indian entity | ODI in foreign entity | Subject to the financial commitment limit, reporting and documentation as per the OI Rules/Regulations and other applicable provisions as under |

| a) Engaged in Financial Services activity | Engaged in Financial Services activity | Subject to the provisions contained in paragraph 2(1) of schedule I of the OI Rules. Where such investment is in IFSC, the requisite approval by the financial services regulator concerned shall be decided within 45 days from the date of receipt of application complete in all respects failing which it shall be deemed to be approved |

| Not engaged in Financial Services activity | Subject to the guidelines issued by the respective regulator | |

| b) Not engaged in Financial Services activity | Engaged in Financial Services activity except banking or insurance | Indian entity has posted net profits during the preceding three financial years. However, an Indian entity not meeting 3-year profitability condition may make such ODI in a foreign entity in IFSC in India. |

| Engaged in general and health insurance | Apart from the 3 years profitability criteria, such insurance business is supporting the core activity undertaken overseas by such Indian entity. For instance, health insurance to support medical/hospital business, vehicle insurance to support the manufacturing/export of motor vehicles, etc. | |

| c) Overseas investment in any sector by banks and non-banking financial institutions regulated by the Reserve Bank shall be subject to such other conditions as may be stipulated by the regulatory department concerned of the Reserve Bank in this regard. | ||

| d) A foreign entity will be considered to be engaged in the business of financial services activity if it undertakes an activity, which if carried out by an entity in India, requires registration with or is regulated by a financial sector regulator in India. |

(8) The limit on financial commitments is determined by paragraph 3 of Schedule I of the Overseas Investment (OI) Rules. Additionally:

a) The utilization of funds held in the Exchange Earners’ Foreign Currency (EEFC) account, as well as the amount obtained through the issuance of American Depository Receipts (ADR) or Global Depositary Receipts (GDR) and ADR/GDR stock-swap for making financial commitments, will be considered within the financial commitment limit. However, financial commitments made through these resources prior to the date of notification of the OI Rules/Regulations will not be counted towards the limit.

b) When the proceeds from External Commercial Borrowings (ECB) are used to make financial commitments, this utilization will be counted towards the financial commitment limit. However, only the portion of the ECB that exceeds the amount corresponding to the pledge or creation of a charge on assets, which has already been included in the financial commitment limit, will be counted.

Overseas investment by resident individuals

With effect from August 05, 2013, resident individuals (either individually or in conjunction with another resident individual or with an Indian entity) were granted the ability to engage in Overseas Direct Investment (ODI). A resident individual can make overseas investments following the guidelines provided in Schedule III of the Overseas Investment (OI) Rules. Additionally:

(1) If a resident individual has made an ODI without control in a foreign entity, and that foreign entity subsequently acquires or establishes a subsidiary or second or subsequent-level step-down subsidiary (SDS), the resident individual is not permitted to gain control in that foreign entity.

(2) Overseas investments involving capitalization, securities swaps, rights/bonus issues, gifts, and inheritances will be categorized as ODI or Overseas Portfolio Investment (OPI) based on the nature of the investment. However, investments, whether in listed or unlisted entities, through sweat equity shares, minimum qualification shares, and shares/interest under Employee Stock Ownership Plans (ESOP) or Employee Benefits Schemes, which do not exceed 10% of the foreign entity’s paid-up capital/stock and do not lead to control, will be categorized as OPI.

(3) In the case of security swaps, both legs of the transaction must comply with the provisions of the Foreign Exchange Management Act (FEMA), as applicable. If a security swap results in the acquisition of equity capital that does not conform to the OI Rules/Regulations (e.g., ODI in a foreign entity engaged in financial services activities or a foreign entity with a subsidiary/SDS), such equity capital must be divested within six months from the date of acquisition.

(4) Resident individuals are not permitted to transfer any overseas investments as gifts to individuals residing outside India.

(5) Shares/interest acquired under ESOP/Employee Benefits Schemes – Authorized Dealer (AD) banks may allow remittances for acquiring shares/interest in an overseas entity under schemes offered directly by the issuing entity or indirectly through a Special Purpose Vehicle (SPV) or SDS. If the investment qualifies as OPI, the employer must report it in Form OPI as per Regulation 10(3) of the OI Regulations. If the investment qualifies as ODI, the resident individual must report the transaction in Form FC.

(6) Foreign entities are allowed to repurchase shares issued to residents in India under any ESOP Scheme, provided that

(i) the shares were issued in compliance with the rules/regulations under FEMA, 1999,

(ii) the repurchase follows the terms of the initial offer document, and

(iii) the necessary reporting is conducted through the AD bank.

(7) While there is no specific limit on the amount of remittance made for the acquisition of shares/interest under ESOP/Employee Benefits Schemes or the acquisition of sweat equity shares, such remittances will count towards the Liberalized Remittance Scheme (LRS) limit of the individual concerned.

Overseas investment by a person resident in India, other than an Indian entity or a resident individual

A person residing in India, who is not an Indian entity or a resident individual, can engage in overseas investment in accordance with Schedule IV of the Overseas Investment (OI) Rules. Additionally:

(1) Mutual Funds (MFs) and Venture Capital Funds (VCFs)/Alternative Investment Funds (AIFs) registered with the Securities and Exchange Board of India (SEBI) may invest overseas in securities as specified by SEBI within an overall cap of USD 7 billion and USD 1.5 billion, respectively, as outlined in paragraph 2 of Schedule IV of the OI Rules. Furthermore, a limited number of eligible MFs are permitted to invest cumulatively up to USD 1 billion in overseas Exchange Traded Funds (ETFs), subject to SEBI’s approval. These investments shall be classified as Overseas Portfolio Investment (OPI), regardless of whether the securities are listed or not.

(2) MFs/VCFs/AIFs interested in availing this facility should approach SEBI for the necessary permissions. The operational details regarding eligibility criteria, individual limits, identification of recognized stock exchanges, the investible universe, monitoring of aggregate ceilings, etc., will be in accordance with the guidelines issued by SEBI. General permission is granted to these investors for selling the securities they acquire.

(3) An Authorized Dealer (AD) bank, including its overseas branch, may acquire or transfer foreign securities in accordance with the regulations and laws of the host country in the normal course of its banking business. The provisions in the OI Rules/Regulations do not apply to such acquisition or transfer of foreign securities by an AD bank.

(4) A bank in India, licensed by the Reserve Bank of India under the Banking Regulation Act, 1949, may acquire shares of the Society for Worldwide Interbank Financial Telecommunication (SWIFT) in line with SWIFT’s by-laws. This is permissible provided the bank has received permission from the Reserve Bank to join the ‘SWIFT User’s Group in India’ as a member.

(5) Any overseas investment made by a sole proprietorship or an unregistered partnership firm can be carried out by the proprietor or the individual partners within their limits under the Liberalized Remittance Scheme (LRS) as per Schedule III of the OI Rules. If the proposed investment is in a strategic sector, any application for an overseas investment exceeding the LRS limit should be made under the government approval route.

(6) Overseas investments by registered trusts and societies may be made under the approval route, in accordance with paragraph 1 of Schedule IV of the OI Rules.

Overseas investment in an IFSC in India by a person resident in India

A person residing in India can engage in overseas investment within an International Financial Services Centre (IFSC) in India in accordance with Schedule V of the Overseas Investment (OI) Rules. Here are some additional details:

(1) A person residing in India, whether it’s an Indian entity or a resident individual, can make investments (including sponsor contributions) in the units of an investment fund or vehicle established in an IFSC as Overseas Portfolio Investment (OPI). This means that, in addition to listed Indian companies and resident individuals, unlisted Indian entities can also make such investments within an IFSC.

(2) The restriction on making Overseas Direct Investment (ODI) only in an operating foreign entity or not making ODI in a foreign entity engaged in financial services activities by resident individuals does not apply to investments made within an IFSC. However, such investments should not be made in any foreign entity engaged in banking or insurance. Such foreign entities in IFSC may have subsidiaries or second or subsequent-level step-down subsidiaries (SDS) in IFSC. They may also have subsidiaries or SDS outside IFSC where the resident individual does not have control over the foreign entity. A resident individual who has made ODI without control is not allowed to gain control in a foreign entity that subsequently establishes or acquires a subsidiary/SDS outside India.

Acquisition or Transfer of Immovable Property outside India

The acquisition or transfer of immovable property outside India is subject to the provisions outlined in Rule 21 of the Overseas Investment (OI) Rules. Additionally:

(1) An Authorized Dealer (AD) bank may permit an Indian entity with an overseas office to acquire immovable property outside India for the business and residential purposes of its staff. This is permissible as long as the total remittances do not exceed the following limits, which are specified for both initial and recurring expenses:

– 15% of the average annual sales, income, or turnover of the Indian entity over the last two financial years or up to 25% of the net worth, whichever is higher.

– 10% of the average annual sales, income, or turnover over the last two financial years.

Conclusion

In conclusion, overseas investments made by Indian residents play a crucial role in expanding the scale and scope of business activities for Indian entrepreneurs. These investments provide access to global opportunities for growth by facilitating technology transfer, research and development, access to wider markets, and reducing capital costs. They enhance the competitiveness of Indian entities and boost their brand value. Additionally, overseas investments contribute to foreign trade, technology transfer, domestic employment, increased investment, and overall global economic growth. The Hon’ble Prime Minister of India, Shri Narendra Modi is also promoting, “One Family. One Future. One Earth.”.

To support and facilitate overseas investments, the Central Government and the Reserve Bank of India have simplified procedures and rationalized rules and regulations under the Foreign Exchange Management Act, 1999. This effort has led to the operationalization of a new Overseas Investment regime, represented by the Foreign Exchange Management (Overseas Investment) Rules, 2022, and the Foreign Exchange Management (Overseas Investment) Regulations, 2022.

These regulations introduce several significant changes to the existing framework, including improved clarity in definitions, the introduction of the concept of “strategic sector,” the removal of the requirement for approval in specific cases, and the introduction of a “Late Submission Fee (LSF)” for reporting delays. These changes aim to reduce the compliance burden and associated costs, making overseas investments more accessible and efficient for Indian residents.

Overall, the regulatory amendments are designed to foster ease of doing business and promote overseas investments while ensuring proper oversight and compliance with FEMA Act, OI Rules, and Regulations. The revised framework supports Indian entrepreneurs in harnessing global opportunities and contributes to their success on the international stage.

Written & Compiled by CA Sunil Kumar Gupta

Founder Chairman, SARC Associates